An introduction to VAT in the UK

Whether you are a small business owner, or an established company operating in the United Kingdom, chances are that you have already opened a file with the HMRC to receive and pay Value Added Tax (VAT), or at least considered doing so in the near future. Often, many investors wonder why VAT exists, and how it is going to help the society and the country at all. In this analysis, we try to understand how the VAT system in the UK works, what happens to collected taxes, and the latest developments. Even though there are a ton of articles on how to register for VAT and how to claim VAT, there is little coverage on why we need to pay VAT and the impact on VAT on the economy of the UK.

The best way to start this discussion is by understanding how VAT works in the UK.

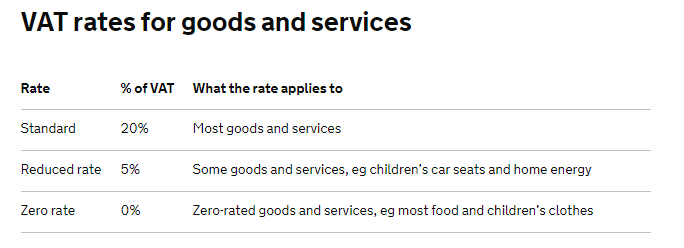

The standard VAT rate is 20% in the UK, but in reality, VAT is charged based on three tiers.

(Source – Government of United Kingdom)

While most goods and services sold in the UK fall under the Standard category, sanitary products, energy saving measures and children’s car seats are charged at the reduced rate of 5%. In addition, most food, children’s clothes, books, and newspapers are not charged VAT, and are rightly called zero rate products.

If your business has an annual turnover in excess of £83,000, the business is expected to have a file opened with the HMRC. However, some businesses opt to register for VAT even if they do not meet this threshold for a couple of reasons. First, some companies want to have an additional appeal to consumers by showcasing how big their company is, and a good way to do this is by opening a file with the HMRC and showcasing this to consumers. On the other hand, if a certain business pays a significant amount as VAT, it might be a good idea to open a file with the government and claim VAT returns as well. Even though claiming VAT returns is an interesting subject on its own, this is not the main theme of this article.

What happens to VAT money collected by the HMRC?

Taxes collected by governments around the world form one of the primary income sources for governments, if not the most important source of income for governments across the world. Many people believe that VAT receipts collected by the UK government go directly into infrastructure developments.

However, the UK government spends tax money on various projects and sectors, and these investments help improve the standards of living in the country.

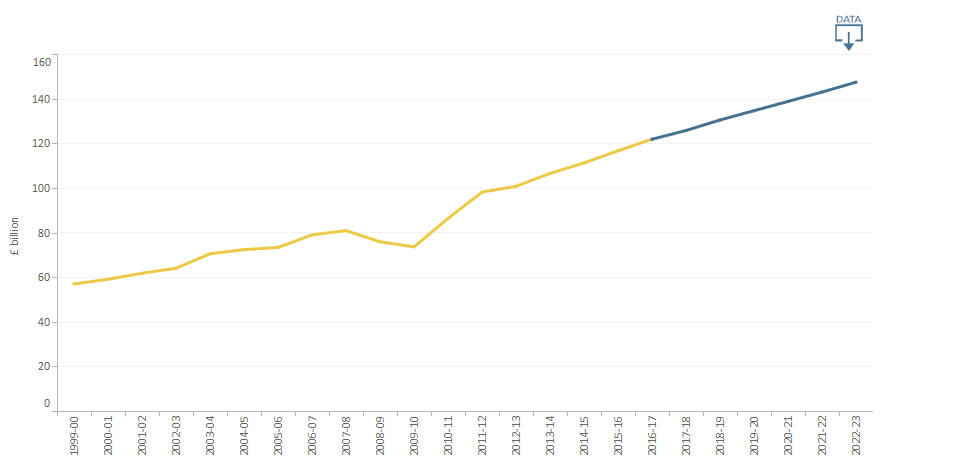

(Source – Statista)

With over £120 billion collected from VAT receipts at present, the government of UK is reliant on these collections to fund most of its welfare payments, healthcare payments, and pension payments. Annual VAT collections are expected to exceed £150 billion by 2023, and the steady rate of VAT payments growth can be attributed to the increased business activities expected in the next 5 years.

VAT receipts forecast

(Source – Office for Budget Responsibility)

Even though this might not be clear at first, higher VAT receipts will eventually benefit the economy as a whole as collected tax receipts are going to be invested by the government, and this will not only improve the lives of UK residents in the future, but also help the GDP growth accelerate through higher spending by the government.

What are the latest developments?

There have been a few developments of late regarding how VAT is being collected and on what products and services are VAT applied. One of the most-recent developments is the VAT implementation for e-commerce businesses. Many online retailers were surprised to see their costs soar due to VAT payments charged on online e-commerce platforms by the regulators.

The most recent development related to UK VAT payments is the expected roll-out of the online tax payment system from April 1, 2019.

The roll-out of the online tax payment system is expected to provide an efficient framework for both the government and taxpayers, and is aimed at helping taxpayers get it right the first time. Even though many businesses want to get their tax submission correct, latest research from the HMRC reveals that many business owners in fact fail to file the correct VAT amounts consistently. The tax gap for 2016-2017 is estimated at £33 billion, which is 5.7% of total tax liabilities.

Tax gap in the UK

(Source – The Government of UK)

The development of the online system is expected to bridge this gap meaningfully, and this is a positive sign for both the government and taxpayers.

In addition to the overall increase in efficiency expected from the roll-out of this digital taxpaying mechanism, this is expected to provide cost benefits to the government as well. The government would then be in a better position to disburse a higher amount of collected taxes for social welfare, and on the other hand, the overall government spending process will also become efficient along with the increased efficiency of collecting taxes.

From the perspective of taxpayers, getting it right the first time would mean lower overheads for small business owners as well, which should improve the overall efficiency of the private sector in future.

I expect the roll-out of this digital taxpaying system to have some confusion in the early stages, but things should settle within a couple of quarters.

In light with the recent changes to the taxpaying mechanism, it’s important to work with a consultant that is ready for this digital innovation as the entire tax system in the UK is expected to go digital by 2020.

Why you should not fail to pay VAT on time?

Failure to make due VAT payments by the deadline might incur surcharges and penalties by the HMRC, and these penalties could add up quickly and become a burden on your business in the near future. Therefore, it’s important to consider VAT payments an integral part of doing your business, and small businesses often do not realize the importance of this. It’s often better to get the help of a tax consultant as well if you’re in doubt as to how you should file your tax returns and pay taxes, especially considering the upcoming digital tax payment system.

Value Added Tax in the UK is something that is not endorsed by many consumers and businesses, but collected tax payments are a major driver of the UK economy, the same way it is for many other developed economies around the world. It’s important to pay VAT on a timely basis, and the recent developments with regard to the digitalization of the taxpaying system raises the importance of working with a consultant who is digital-ready.